A Smart, Tax-Friendly Way to Support The Center

Did you know that if you’re age 70½ or older, you can make a gift to The Center of Anna Maria Island directly from your IRA? It’s asurprisingly easy—and very tax-friendly—way to support the programs, services, and community connections that make The Center such a special place. And because your gift comes straight to us, 100% of it goes right back into our community, just the way you intend!

A Win-Win for You and The Center

If you are required to take a Required Minimum Distribution (RMD) this year, your IRA gift can count toward all or part of that amount. It’s a simple way to meet your RMD while supporting the mission you care about.

And if you’re thinking about ways to lower your taxes before the end of the year, this often-overlooked option may be exactly what you need.

Smart Giving From Your IRA

A Tax-Saving Way to Support The Center of Anna Maria Island

With an IRA charitable rollover—also known as a Qualified Charitable Distribution (QCD)—you can make an immediate impact while potentially saving on taxes.

A Special Opportunity for Those 70½ Years Old and Older

You can give any amount (up to $108,000) this year from your IRA directly to a qualified charity like The Center without paying income taxes on the transfer. Whether your gift is large or small, it’s eligible for this benefit—and it goes to work right away to strengthen our community.

Why Consider a Gift from Your IRA?

-

See your impact today. Your support immediately benefits the programs and services that matter most to you.

-

Meet your RMD the easy way. Your IRA gift can satisfy all or part of your required minimum distribution.

-

Pay no income taxes on the transfer. Because the gift is made directly from your IRA to The Center, it generates neither taxable income nor a tax deduction—meaning you benefit even if you do not itemize your taxes.

-

Reduce your taxable income. This can help lower your Medicare premiums and decrease the amount of Social Security that is subject to tax.

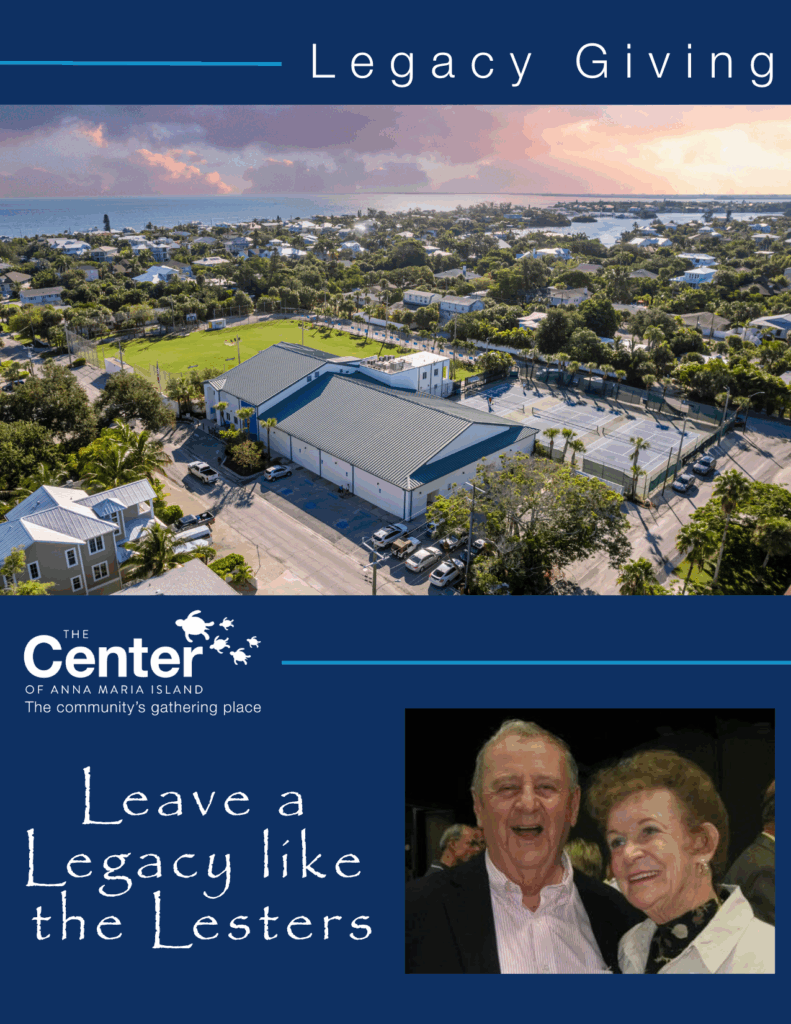

Your generosity helps The Center continue to thrive.

In this season of giving, a gift from your IRA can create a meaningful and lasting legacy right here at home. We are deeply grateful for the kindness and care you share with our community.

If you’d like more information about how to make a Qualified Charitable Distribution to The Center, we’re here to help. Please contact us anytime, development@centerami.org, we’d be happy to walk you through the process.